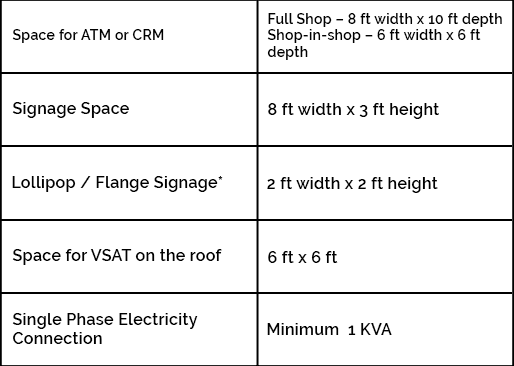

Minimum Requirement

Hitachi Money Spot ATM Franchise Apply: a Profitable Prospect for Future Business Owners

Convenience in banking transactions is more important than ever in the hectic environment of today. Despite the growing digitalization of banking services, a service that is still in great demand, ATMs—Automated Teller Machines—are very essential in guaranteeing rapid and simple access to cash. As ATM networks spread throughout urban and rural regions, businesses seeking investments in the financial services sector have more chances. The Hitachi Money Spot ATM franchise is one such possibility; it is a franchise concept with consistent revenue stream and attractive returns. This page covers everything you need to know about applying for a Hitachi Money Spot ATM franchise and the reasons it could be a wise investment for you.

Know what is Hitachi Money Spot ATM

Renowned Indian financial services business Hitachi Payment Services focuses on ATMs’ installation and administration. Their large network includes Hitachi Money Spot ATMs, which guarantees consumers all around have access to cash services as needed. These ATMs provide consumers safe, dependable, and quick banking experiences and are designed to run successfully in highly demanded areas.

The company’s goal is to improve financial inclusion, especially in rural and semi-urban regions where access to banking facilities could be restricted. Hitachi Payment Services has effectively increased its presence throughout India by working with franchisees, therefore helping to fulfill its aim of empowering people and companies by simpler access to financial services.

Why Would One Invest in a Hitachi Money Spot ATM Franchise?

For many different reasons, investing in an ATM franchise might be wise. Here is the rationale:

An ATM franchise offers one of the main advantages in terms of passive revenue stream. Your primary responsibility once your ATM is operational will be maintenance and cash replenishment. Every transaction done using the ATM generates a service charge, which offers consistent revenue.

High need for ATMs: Particularly in semi-urban and rural regions, the need for ATMs is strong even with the rise in internet banking and digital payments. Cash is still the currency used in many daily transactions, hence ATMs are a necessary service.

Running an ATM calls for few daily overheads. This is a low-maintenance company model as there is no personnel, inventory, or marketing costs.

As a franchisee, Hitachi Payment Services will provide you thorough assistance with installation, administration, and maintenance. They will provide the required customer service infrastructure, training, and technological tools.

Running a Hitachi Money Spot ATM helps to promote financial inclusion, especially in places where banking facilities are few. This not only helps the nearby economy but also makes you feel successful.

Franchise Hitachi Money Spot ATM – A Perfect Business Model

Operating on a business model wherein franchisees join with Hitachi Payment Services to build and oversee ATMs in specified sites, the Hitachi Money Spot ATM franchise Hitachi takes care of the technical elements including installation, software, and hardware maintenance; the franchisee is in charge of the site.

The ATM makes money after it’s set up via transaction fees. The franchisee is paid a commission each time a consumer checks their balance, takes money out, or does any financial activity. Particularly in busy regions, these commissions may build up to be a sizable monthly income.

Processes for Requesting a Hitachi Money Spot ATM Franchise

Here are the main actions to apply for a Hitachi Money Spot ATM franchise if you would like to be a franchisee:

Before applying, be sure you satisfy Hitachi Payment Services’ minimum eligibility standards. Usually, they include on being an Indian citizen with a solid financial history and a good site for ATM installation.

One of the most important decisions this company makes is where to site the ATM. Ideal high-foot traffic locations include retail centers, markets, transit hubs, residential districts, and sites close to government buildings. Additionally profitable are semi-urban and rural locations where ATM penetration is minimal.

Online Application: Hitachi Payment Services has streamlined franchise application procedure. An official website of theirs allows you to apply online. The application will request personal information, financial history, and specifics about the suggested ATM site.

Following the submission of your application, you will be required to provide papers proving your identification, financial stability, and ownership or lease agreement of the property from where the ATM will be placed. Usually, documents needed include identification evidence (aadhar card or PAN card), address proof, property documentation, and bank statements.

Once your application and documentation are sent in, the firm will go over your idea. This covers your financial background check and a feasibility research of your suggested site. Should your approval be granted, you will get a confirmation and the following installation actions will start.

Installation and Setup: Hitachi Payment Services will handle ATM installation upon clearance. They will arrange the machine, link it to the banking network, and guarantee it’s ready for usage. They will also provide you the required instruction to run and control the ATM effectively.

Hitachi Money Spot ATM Franchise Financial Requirements

Although the location and size of the ATM installation may affect the precise revenue figures, here is a broad estimate:

Like every franchise concept, there will be an upfront franchise fee. This pays for initial setup, the software, and ATM installation expenses. The cost may fall anywhere from ₹2,00,000 to ₹5,00,000.

Hitachi Payment Services might demand a security deposit to guarantee ATM safety and correct operation. Usually at the conclusion of your franchise agreement, this is refundable.

Once the ATM is working, minimal maintenance and cash replenishment will be your major running costs. When compared to other franchise companies, these expenses are quite modest.

The daily transaction count of the ATM determines the revenue potential. An ATM may do hundreds of daily transactions in busy regions, therefore generating a sizable monthly revenue. Usually, each transaction brings in between ₹8 and ₹15 for the fee.

Issues to Think About

Although the Hitachi Money Spot ATM franchise has many benefits, there are a few things you should know:

Regularly refreshing cash in the ATM might be difficult, particularly in rural locations.

Technical Maintenance: Hitachi offers technical help; still, you should keep an eye on the ATM for any problems that can develop and guarantee quick fixes.

Choose a safe and secure place as ATMs are sometimes prone to theft or damage.

Applying for a Hitachi Money Spot ATM franchise is ultimately a fantastic approach to leverage India’s rising financial service market. It offers a good investment possibility with minimal running expenses, a consistent revenue stream, and Hitachi Payment Services’ assistance. Starting with this very profitable business concept by completing the application procedure and selecting the appropriate site will help you to start making money.